Buying

What you should know about the Purchase Process in Spain.

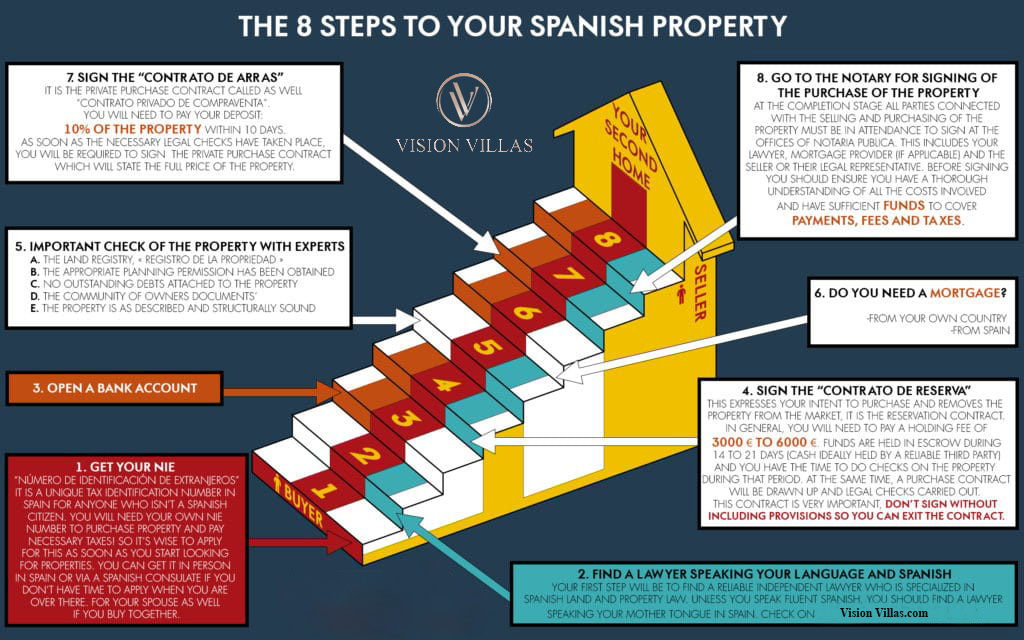

We have made you a 8 Step to your spanish property plan:

The buying process can differ from country to country, so here are some useful information for you of how it works here in Spain.

When purchasing a property in Spain, there are taxes and fees that need to be considered. Vision Villas suggests budgeting between 11-13% on top of the purchase price to cover these expenses.

The largest cost is the 10% purchase tax paid to the government upon completion and signing of the deeds at the notary.

Additional costs include notary fees ranging from 0.5 to 1% of the purchase price, and land registry fees of approximately 1%.

We recommend to have a Lawyer or Gestor handle the conveyancing for the property purchase and to check all the legally required paperwork.

Their fees can vary from a fixed fee to around 0.5% of the purchase price. It is important to choose a reputable professional, and Vision Villas can provide a list of recommended conveyancers.

Other fees to consider are mortgage arrangement fees (if applicable) and fees for granting power of attorney to your lawyer if you cannot be present for signing.

It is best to budget at least 12% and potentially 13% to cover any unexpected fees and taxes.

Budget

Being aware of the cost coming up towards you will help you plan and determine what properties you can look at.

Taking into account the top end budget for taxes and fees (13% of the purchase price) may significantly reduce the amount you thought you could spend. For example, a 500k budget may be reduced to around 435k.

If you require a mortgage, it is recommended to consult with a mortgage advisor before setting your budget.

Your budget will determine the type and location of the property you can purchase in Spain.

Mortgages

Many people require a mortgage to purchase a property. If you meet the criteria to satisfy a mortgage lender as a British or international resident, you can be granted a mortgage.

The mortgage is based on your earnings and affordability. Typically, the lender will consider the monthly repayment to be 30% of your expendable income.

Currently, non-residents of Spain are allowed to borrow 70% of the purchase value, excluding taxes and fees, Residents can get granted 80% of the purchase value if they can provide sufficient financial history.

Vision Villas collaborates with reputable mortgage advisors in different towns like Moraira, Benissa and Javea who can assist you in securing a mortgage for your dream property.

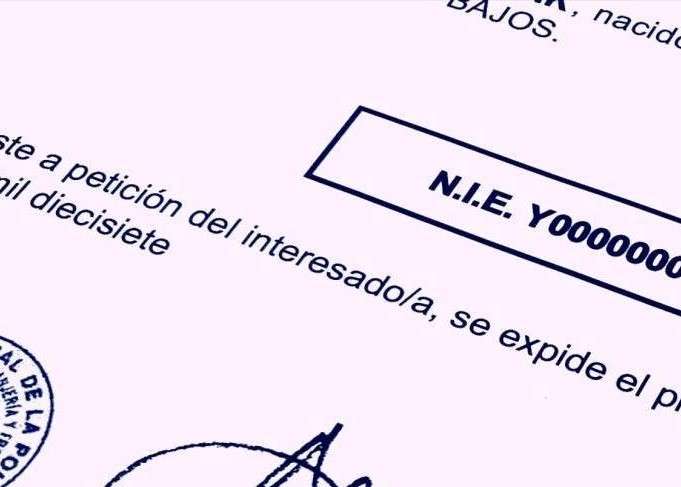

NIE Number

The NIE number, or Foreigners Identification Number, is necessary for various procedures in Spain.

There are several offices where the NIE can be obtained, with the closest to Javea being in Denia.

You can make an appointment and return with the required documents, pay a small fee, and obtain an NIE.

Alternatively, you can hire a Gestor to handle this process for a small charge.

The NIE number is needed for tasks such as opening a bank account (resident or non-resident),

purchasing a car and sometimes receiving packages through the postal system.

The NIE number is issued as a paper certificate with a stamp and signature from the National Police.

This certificate is valid for three months from the date of issue, while the NIE number itself is valid for life.

Since 2005, the NIE number has become a requirement for individuals conducting any business in Spain involving buying or selling items.

The Spanish government has linked the NIE number to other departments, including theSocial Security and residence card.

While it is possible to obtain an NIE number through the Spanish Embassy, it is more common to obtain it through local offices in Spain.

Bank Account

Opening a bank account is an essential step to enable to reside or spend a period time in Spain, so you are able transfer money for your purchases and to pay ongoing bills such as mortgage, rates and utilities. It is a simple process similar to any other European country.

If you are planning to buy a property in Spain, or planning to live for six months or longer in Spain you will need to open an account with a Spanish bank.

You will need the following documents to be able to open an account:

• Proof of Identity - must be photographic, a passport is the best option.

• NIE number - Find out what an NIE number is and how to get them here.

• Proof of address - this can be a utility bill which has been issued within the last 3 months.

Vision Villas will happily help you find the right bank for your needs here in Spain.

Reservation contract and Deposit

If you have found your dream home and your offer was accepted the real estate agent will draw up a reservation contract.

The reservation amount depends on the value of the house but in most instances it is 5,000 euros.

This contract will state the following data:

- Both the vendors and the buyers personal details

- the agreed sales price

- the timescales to complete checks, attain mortgage approval, pay the further 10% deposit and complete the purchase

- the amount of the deposit (usually 10%)

- the date of the signing at the notary

- what is included in the sales price (the property will be bought as seen or if some changes were agreed upon, furniture or without furniture)

- possible extra clauses if documents are missing or dates might be changed

After both parties have signed the Reservation contract and the payment of the reservation fee has been made, the property is taken from the market and unavailable to other potential buyers whilst the private purchase contract (ARAS) is drawn up. This deposit in most cases is non-refundable.

If you require mortgage approval, you also need to negotiate that this is a clause in the reservation contract. Some owners may not agree to this clause as it can mean taking their property from the market for several weeks only to find out that the purchaser has not been approved for a mortgage.

The reservation is usually paid to the estate agent to hold until your lawyer/gestor makes the preliminary checks on the property, ensure the deeds are correct and there are no outstanding debts on the property and if you need a mortgage, the bank will send a valuer to the property to ensure it is worth what you are paying for it.

When your lawyer has completed the checks and the bank, if applicable, has approved the mortgage in writing, then a further 10% deposit is paid (less the reservation deposit amount). Although with a new build property this could be 30-40% of the purchase price, depending on the terms agreed with the builder. A purchase contract is then drawn up.

Purchase Contract

A Purchase Contract follows on from the reservation contract. It is more detailed contract that states the terms of sale. At the point of signing the Purchase Contract- a 10% deposit of the purchase price is paid on re-sale properties and usually around 30% on new build properties, depending on the terms layout by the builder or promoter.

The Purchase Contract will cover all areas of the sale, including what the vendor is responsible to provide. Some property is sold as seen, others you may have negotiated certain commitments from the vendor.

The vendor has to present:

- the title deeds

- the CEE ( Energy Certificate)

- ideally Cedula ( Certification of habitilidad)

- the last IBI payment

- the last water and electricity bills

- community fees if existing

The agent or the lawyer will check as well the Nota Simple to see if there are any more debt on the property so that the property will be sold without outstanding charges.

There may also be the purchase of furniture involved in the sale and an inventory of which is included in this document.

The document also lays out the completion date for the sale at the Notary. If for any reason you do not complete on this date and without prior written agreement to a change of date -you will lose your 10% deposit.

Gestors / Lawyers

A gestor or lawyer can arrange for your NIE, Residencia and Padron, helping you through the process that at times can be time consuming and frustrating when you don’t know the system or cannot speak the language.

They can re-register a car, change your address with the traffic office and the townhall if needed. Ensure all your local taxes and bills are paid, including car tax and IBI rates, change direct debits for bills and many other administration tasks that you would rather pay them to do, to save time and hassle.

When purchasing a property it is highly recommended that you employ an Abogado or a Gestor specialising in conveyancing. They will be your representative to work with the vendors lawyer or representative to ensure that the property is fit for sale.

The majority of houses are fully registered and have no problems, but by employing a lawyer you can get peace of mind that your purchase will go smoothly.

Over the years the purchase of property in Spain has become much more regulated but there are still some areas where you really need a lawyer to ensure the property and its parts are correctly registered with the townhall and is owned in full by the vendor- whether the property is legally registered, are any extensions included in the deeds, has planning permission been granted for extensions and in some instances pools.

Notary

In Spain you cannot register a property with the land registry without the deeds being witnessed and signed by the Notary. Notaries are highly regarded in Spain and most have worked many years in the system before becoming a Notary. It is a very prestigious occupation and their fees reflect this.

They are a professional in the Spanish legal system that will oversee the signing of contracts and agreements by personal or professional parties.

Although they are a commercial entity and earn their fees from private individuals and companies, they are essentially a public figure, who draft, oversee, signand witness in an impartial role.

Along with property purchases, Notaries will be involved in other legal contracts. If you are unable to attend to sign a contract, you can give power of attorney, this is witnessed and signed by the notary.

If you own property in Spain you will want to make a Spanish will, again this will need to be witnessed and signed by the Notary. On the day of the signing The Notary will have a record of all payments that have been made already, from the Reservation fee to the Deposit.

Often the outstanding amount of the purchase price is transferred to an account from the Notary ( as a 3rd independent party) and at the date of the signing the notary will ready out all the payments to the different accounts. Some costs and taxes will already be withdrawn there and then, before the Notary will send out the remaining amount of the sales price to the vendors.

Normally the lawyer will take charge of explaining the buyer the scheduled payments.

Congratulations!

After the signing at the Notary the buyer of the property is instantly the new owner, to time for congratulations.

The buyers will receive all the keys to the property at the Notary already and can start enjoying their new Home in the sun straight away.

I hope this has helped you understand the buying process here in Spain.

Of course, if you have any further questions, please don’t hesitate to contact us, we are with you every step of the way.